Stock Market

Nvidia recognized as top ‘rebound’ stock as Wall Street suggests recent downturn is exaggerated.

Discover why NVIDIA Corporation NASDAQ: NVDA is Wall Street’s top ‘rebound’ pick. Learn about the stock’s potential and why analysts believe recent declines may be overblown.

NVIDIA Corporation (NASDAQ: NVDA) has been a giant in the tech world for over 20 years. Its stock has soared by 25,514% in the last 20 years, far outdoing the broader market. Last year was a big year for Nvidia, with its shares jumping 238%. This was more than the tech-heavy NASDAQ Composite’s 43% gain.

This success came from Nvidia’s strong quarterly results in fiscal 2024. It showed the company’s strength and growth potential.

In the third quarter ended October 29, 2023, NVIDIA saw a huge revenue jump to $18.1 billion, up 206% from the year before. Adjusted earnings per share soared more than six times to $4.02. This was thanks to strong demand for its data center and gaming products.

The Gaming segment saw an 81% growth during this period. This shows how popular Nvidia’s products are.

Despite U.S.-China trade concerns, Nvidia has found ways to overcome these issues. Wall Street expects Nvidia to keep growing, possibly pushing its stock price up. Some analysts even set a Street-high target price of $1,100 for it.

Nvidia leads the GPU market and is a leader in AI chip designs. This makes it a top ‘rebound’ stock. Wall Street believes the recent drop in its stock price is too low.

NVIDIA Corporation NASDAQ: NVDA – The Semiconductor Juggernaut

NVIDIA leads the GPU market with its innovative chip designs. This has made it a top choice for industries needing powerful computing. The company is always pushing the limits of GPU technology and AI chip designs.

NVIDIA’s market value is over $3 trillion, showing its huge lead in semiconductors. In the first quarter of fiscal 2025, its revenue jumped 262% to $26 billion. Adjusted earnings soared 461% to $6.12 per share. This strong performance has caught Wall Street’s eye.

Analysts like Oppenheimer’s Rick Schafer and Barclays’ Tom O’Malley have set price targets for NVIDIA stock. The stock has gone past $130, thanks to high demand for its H100 and Blackwell chips. Schafer believes NVIDIA’s value is justified by its work in AI, data centers, and autonomous vehicles.

NVIDIA is a big player in the semiconductor industry, seen in many ETFs. The Global X Robotics and Artificial Intelligence ETF (BOTZ) has 9% of its assets in NVIDIA. The VanEck Semiconductor ETF (SMH) holds 20.7% of its assets in the company. The Technology Select Sector SPDR Fund (XLK) also has 4.6% of its assets in NVIDIA, worth over $3 billion.

NVIDIA is a leader in GPU technology and chip designs, with strong financials. It’s set to keep leading the semiconductor industry for years.

Nvidia’s Stellar Performance in Fiscal 2024

Nvidia, a leader in semiconductors, made huge strides in fiscal 2024. It set new records in finance, surprising everyone. The company’s top-notch data center and gaming products led to huge revenue and earnings growth.

In the third quarter of fiscal 2024, Nvidia’s revenue jumped by 206% from last year and 34% from the previous quarter to $18.1 billion. This was thanks to strong growth in its Data Center and Gaming segments. These segments saw revenue jump by 279% and 81%, respectively, from the same period last year.

Nvidia’s success wasn’t just in revenue. It also set new earnings records. Adjusted earnings per share went up more than six times from last year, hitting $4.02. This was a 49% jump from the previous quarter.

The company’s strong fiscal 2024 was marked by robust free cash flow. It hit $15.7 billion for the first nine months of the fiscal year. This strong cash flow lets Nvidia fund new projects, pay off debts, and increase dividends to shareholders.

Nvidia’s success in fiscal 2024 came from meeting the growing need for its innovative GPUs and chip designs. This was especially true in the data center and gaming markets. As Nvidia keeps innovating, investors and analysts see big growth and success ahead.

“Nvidia’s outstanding performance in fiscal 2024 demonstrated the company’s ability to capitalize on the growing demand for its high-performance GPUs and innovative chip designs across various industries, particularly in the data center and gaming markets.”

Navigating the U.S.-China Trade Tensions

Nvidia’s fiscal 2024 performance was impressive, but U.S.-China trade issues now threaten its future. The U.S. Commerce Department has limited the export of advanced computer chips to China. This has made Nvidia rethink its strategies to deal with these trade restrictions.

About 20%-25% of Nvidia’s Data Center revenue comes from China and other affected countries. This has led to a small drop in revenue for the fourth quarter. But, Nvidia expects to make up for this loss by growing in other areas.

Nvidia is showing its quick thinking by coming up with new solutions. For example, it’s launching the GeForce RTX 4090 D, a gaming chip made to meet the new U.S. export rules for China. This move shows Nvidia can adjust to new rules and keep its top spot in the market.

- U.S.-China trade restrictions have impacted 20%-25% of Nvidia’s Data Center revenue

- Nvidia anticipates a minor decline in revenue due to the export controls

- Nvidia has developed the GeForce RTX 4090 D, a modified chip to comply with the new regulations

The semiconductor industry is facing big challenges with U.S.-China trade tensions. But Nvidia’s quick thinking and new strategies show it can keep growing despite these issues.

The AI Wave: Nvidia’s Next Big Growth Driver

Nvidia, a leading chip maker, is ready to tap into the booming AI market. Its CEO, Jensen Huang, says the “second wave of AI has begun.” This means AI is becoming a big part of many industries. This is a big chance for Nvidia to grow as the AI market expands.

Nvidia is growing thanks to its work with top companies worldwide. Its Automotive segment grew 4% last quarter. This is thanks to Nvidia’s partnership with Foxconn to make new electric vehicles. Also, the PC market is expected to bounce back, which could help Nvidia’s sales.

Nvidia is moving into new areas like data centers and self-driving cars. This requires careful planning but Nvidia is up for the challenge. It’s keeping its core strengths while exploring new areas. With Nvidia making 80% of AI chips and its new tech offering big savings, it’s set to benefit from the AI boom.

“Nvidia’s shares have soared 2,500% over the past five years, and the shares have advanced about 120% since the start of this year.”

More companies are talking about AI in their meetings with investors. This could mean big growth for Nvidia. But, the company needs to handle mixed feelings about generative AI. Despite this, Nvidia’s flexibility and strong partnerships put it in a good spot for future growth.

Wall Street’s Bullish Outlook on Nvidia

Wall Street is very positive about Nvidia, with most analysts recommending a “strong buy.” Of the 35 analysts tracking Nvidia, 30 suggest a “strong buy.” Three recommend a “moderate buy,” and two say “hold.” The average target price is $653, which means a 35% increase in the next year.

Nvidia’s valuation looks good, with a price-to-earnings ratio of 24 for fiscal 2025. This is lower than its past average. Analysts expect Nvidia’s revenue and earnings to jump by 54% and 62% in fiscal 2025, showing strong growth.

Even with market ups and downs, analysts are still optimistic about Nvidia’s future. They see Nvidia’s lead in the GPU market, its innovative chips, and moves into AI and self-driving cars as key strengths. These factors will likely push Nvidia’s stock up in the next few years.

Stock Market

Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT)

Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT) leads in augmented reality (AR) toys and games for kids. It’s a public company known for its innovative products. These products mix the latest technology with fun educational content. This makes learning and playing better for kids.

Key Takeaways

- Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT) is a leading innovator in the field of AR toys and games for children.

- BHAT’s products combine cutting-edge technology with engaging educational content to enhance the learning and play experience for young audiences.

- The company is publicly traded and has earned a reputation for its innovative offerings in the augmented reality toy and game market.

- BHAT’s focus on integrating technology and education sets it apart in the children’s entertainment industry.

- As a publicly traded company, BHAT provides investors with an opportunity to explore the growth potential of the AR toy and game market.

Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT): A Rising Star in the Gaming Industry

Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT) leads in the augmented reality (AR) toy and game industry. It’s making a splash with its innovative and fun products for kids. By mixing learning with fun, BHAT has found a special spot in the market. It draws in young people with its advanced AR tech.

Company Overview and Key Products

Since 2010, BHAT has been a pioneer in AR gaming. Its main products are AR toys and games that mix digital and real worlds. These products offer interactive learning and exciting games. They aim to boost creativity, improve thinking skills, and get kids excited about tech early on.

The AR Dinosaur is one of BHAT’s top products. It lets kids meet digital dinosaurs in real life. With the latest AR tech, they can learn about these dinosaurs, watch their behavior, and even play virtual battles safely at home.

Growth Strategies and Market Opportunities

The AR gaming world is growing, and BHAT is ready to take advantage of it. The company is focusing on new products and partnerships for big growth in the future.

BHAT plans to add more AR products for different ages and interests. It’s also looking to work with top content creators and brands. This will help make even more exciting AR experiences for kids.

With more kids learning from home and loving immersive tech, BHAT’s AR toys and games are set to grab a big part of the market. Parents and teachers are looking for fun and educational ways to keep kids engaged.

BHAT is becoming a big name in the gaming world with its new products and growth plans. It’s set to win over kids all over the globe with its innovative AR tech.

Decoding the Financial Performance of BHAT

Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT) stands out in the gaming industry with strong financials. By looking at its financial reports and stock analysis, we see its financial health and growth potential. This gives us a clear view of its financial strength and its ability to seize growth chances.

BHAT’s financial reports show steady growth in revenue and smart cost management. The stock’s steady rise in value shows investors believe in BHAT’s growth plans and long-term value. This confidence is a sign of the company’s strong financial health.

Looking at financial metrics like profitability, liquidity, and solvency, we see a company that’s financially solid. It’s ready to face industry challenges. With its strong finances, innovative products, and strategic plans, BHAT is set for ongoing success in the gaming world.

FAQ

What is Blue Hat Interactive Entertainment Technology (NASDAQ: BHAT)?

What are some of BHAT’s key products?

What are BHAT’s growth strategies and market opportunities?

How is BHAT performing financially?

What are the latest industry trends in the AR gaming market?

Stock Market

Cingulate Inc Nasdaq: CING up over 200%

Cingulate Inc. (NASDAQ: CING) has seen its stock price jump by over 200%. The company ended the day at $0.437 per share, up 1.63%. Now, its market cap is $3.15 million, and its enterprise value is $6.93 million.

Even with its big increase, Cingulate Inc. has hit some bumps recently. The stock fell by 59.81% in the last quarter and 56.14% over the year.

Cingulate Inc (CING) Stock: A Remarkable Surge

Cingulate Inc. (NASDAQ: CING) stock has seen an amazing rise. Its shares jumped over 200%, now trading at $0.437 per share. This big jump has made investors and analysts take notice, leading to a deeper look into what’s behind this cingulate inc stock performance.

Cingulate Inc (CING) Stock Price Today: $0.437, Up Over 200%

Recent data shows Cingulate Inc.’s stock price has soared by over 200%. This cingulate inc cing stock price increase is due to good news and positive views on the company’s future.

Despite monthly, quarterly, and yearly drops of 38.57%, 59.81%, and 56.14%, the stock’s recent rise has sparked renewed interest and hope. This shows the company’s cingulate inc stock performance is strong.

“The recent surge in Cingulate Inc.’s stock price has been a remarkable turnaround, defying the broader market trends and showcasing the company’s resilience and potential for growth.”

Investors are keeping a close eye on the cingulate inc cing stock price increase and the company’s cingulate inc stock outlook. It’s important to follow the latest news and financial updates to understand the future of this interesting biotech firm.

Cingulate Inc: Financial Overview

As an investor, knowing about Cingulate Inc.’s (NASDAQ: CING) finances is key. Let’s look at the main numbers that show how the company is doing financially.

Cingulate Inc.’s market cap is 3.93 million USD, which is smaller than many others in its field. The latest earnings per share (EPS) is -27.3156 USD, showing it’s not making money right now.

The price-to-earnings (P/E) ratio of -0.17 means the stock might be cheaper than it should be. But, we need to check the financial statements closely to understand the company’s true financial state.

Over the years, Cingulate Inc.’s assets have changed a lot, from 7.16 million USD to 5.79 billion USD. Liabilities have also changed, from 2.04 million USD to 11.33 million USD. Equity has seen big changes too, from -6.87 million USD to 82,000 USD.

The company’s cash flows from operations, investments, and financing have been all over the place. Operating expenses have been between -3.58 million USD to -15.03 million USD. Investing activities have changed a lot, from -37,000 USD to -224,000 USD. Financing activities have also varied, from -4,000 USD to 9.96 million USD.

Looking at the company’s shares gives us more clues. There are 861,600 shares outstanding, with 429,040 traded weekly and 357,440 monthly. The stock price has dropped by -64.89% in a year, reaching a high of 15.60 USD and a low of 0.2145 USD. Right now, the stock’s spread is 0.04 USD, or 0.87%.

Cingulate Inc.’s finances show both good and bad signs. Investors should look closely at the company’s financials and the industry to make smart choices.

“The financial overview of Cingulate Inc. provides valuable insights into the company’s financial health and growth potential, which are crucial factors for investors to consider.”

Cingulate Inc Nasdaq: CING Key Metrics

As an investor, it’s key to look at a company’s financial metrics closely. This helps make better investment choices. Let’s dive into the main metrics of Cingulate Inc. (NASDAQ: CING), a growing biotech in healthcare.

Cingulate Inc. has a Price-to-Earnings (P/E) ratio of -0.67. This means the stock might be cheaper than its earnings suggest. The Enterprise Value to Sales (EV/Sales) ratio isn’t given, hinting the company might not have much revenue yet. The Enterprise Value to EBITDA (EV/EBITDA) ratio of -0.39 shows the company’s financial health.

The Price-to-Sales (P/S) ratio isn’t listed, and the Price-to-Book (P/B) ratio is 2.94. This could mean the stock is more expensive than its book value. Cingulate Inc.’s PEG ratio of -0.04 suggests the stock might be cheaper than its growth potential.

Also, the company’s Earnings per Share (EPS) is -$22.68. This shows the company is currently losing money.

These metrics give us a peek into Cingulate Inc.’s finances and value. As an investor, it’s vital to look at these numbers with the company’s business strategy, market spot, and growth outlook. This helps in making a well-rounded investment choice.

Cingulate Inc (CING) Stock Performance

Cingulate Inc (NASDAQ: CING) has seen a big jump in its stock price, going up over 200% recently. The company’s market capitalization now stands at $1.75 million USD. However, it dropped by 24.16% over the last week.

The stock’s ups and downs are clear from its all-time high of $1,236.00 USD on December 8, 2021, and its all-time low of $1.82 USD on August 9, 2024. Over the past year, Cingulate Inc’s stock performance has dropped by -96.30% compared to the year before.

Even with the recent stock price jump, the company’s financial performance is not strong. It had negative earnings per share (EPS) of $-5.47 USD last quarter and is expected to have $-5.64 USD per share this quarter. But, analysts are hopeful, giving it a consensus “OUTPERFORM” rating and an average target price of $240.00 USD.

Cingulate Inc’s stock volatility is shown by its beta coefficient of 0.00, indicating high volatility. The company’s next earnings report is set for November 11, 2024. This will give more insight into its financial health and future outlook.

“Cingulate Inc’s stock performance has been a rollercoaster ride, with significant ups and downs in recent months. While the recent surge may have caught investors’ attention, the company’s financial metrics and analyst estimates suggest a cautious approach may be warranted.”

Overall, Cingulate Inc (CING) stock has shown volatile and unpredictable performance. The company’s financial health and future prospects are still concerns for investors. It’s important for the company to prove its worth and show steady profits to back up the current stock price and analyst hopes.

Cingulate Inc (CING) Financials and Estimates

Cingulate Inc. (NASDAQ: CING) is a biopharmaceutical company working on new treatments for the brain. They have shown strong financial growth and potential. Let’s look at the main financial highlights and predictions for this exciting company.

The latest cingulate inc financial statements show a changing cingulate inc balance sheet. The debt to assets ratio varied from 41.47% to 296.75% in the past year. The cingulate inc cash flow also changed a lot, from -$8.74 million to $9.88 million each quarter.

Even with ups and downs in finances, Cingulate Inc. has made big strides. They got a green light from the FDA for their Phase 3 drug for ADHD treatment. This shows their dedication to bringing new treatments to the ADHD market.

The ADHD market is a big chance for Cingulate Inc. In the U.S., about 6.4 million kids and teens have ADHD, and 80% get treatment. For adults, it’s around 11 million, but only 20% get help. Cingulate’s new technology could change the game, helping many more people.

As Cingulate Inc. moves forward with its research and finances, everyone is watching. Investors and experts will keep an eye on their cingulate inc financial statements, cingulate inc balance sheet, and cingulate inc cash flow. They want to see how the company will grow and stand out in the market.

Hedge Funds Holdings and Insider Trading of Cingulate Inc (CING)

Looking into hedge fund ownership and insider trading of Cingulate Inc (NASDAQ: CING) shows some interesting facts. Hedge funds hold a small but significant part of CING stock, showing they believe in the company’s future. Insider trading, like when top managers or big shareholders buy or sell, can tell us a lot about the company’s mood.

The data doesn’t give a clear picture of how much Cingulate Inc. is owned by hedge funds in the first quarter of 2023. But, the fact that hedge funds do own some shares means they see value in the company. They’re ready to invest in its success.

Looking at insider trading for Cingulate Inc. (NASDAQ:CING) in 2022 and 2023, we see that insiders have made different numbers of trades. But, there have been no sales. This could be a good sign. It might mean insiders are confident in the company’s future and don’t want to sell their shares.

Stock Market

AST SpaceMobile NASDAQ:ASTS Surge Trending Up This Morning

This morning, AST SpaceMobile (NASDAQ:ASTS) saw a big jump in trading. Its stock went up by over 30% by midday. This rise is due to several important updates about the company.

First, AST SpaceMobile filed to sell 10.45 million shares. This shows more people believe in the company’s growth and its market value. Also, the company is getting a boost from Apple Inc.’s (NASDAQ:AAPL) new iOS 18 update.

This update lets iPhone 14 users send messages via satellite without needing cell service. This has made people very interested in satellite communications again.

AST SpaceMobile has also teamed up with big names like Verizon Communications Inc. (NYSE:VZ) and AT&T Inc. (NYSE:T). They’re working together to bring a broadband network straight to cell phones. This new way of connecting is expected to help the company grow even more.

AST SpaceMobile NASDAQ:ASTS Gains Over 30% on Resale Filing and iOS 18 Satellite Messaging

AST SpaceMobile NASDAQ:ASTS has seen its stock price jump over 30%. This jump is thanks to two big events. First, the company shared plans to sell up to 10.45 million shares. Second, Apple Inc.’s (NASDAQ:AAPL) iOS 18 was launched with satellite messaging.

Company Discloses Resale of 10.45 Million Shares by Selling Stockholders

AST SpaceMobile filed a statement with the SEC. It allows for the sale of up to 10.45 million shares by some investors. This move means these investors can make money and shows they believe in the company’s future.

Apple’s iOS 18 Launch with Satellite Messaging Boosts Sympathy Trading

The launch of iOS 18 by Apple Inc. (NASDAQ:AAPL) has also helped AST SpaceMobile’s stock. iOS 18 lets users send messages via satellite, even without cell service. This has led to more investors buying AST SpaceMobile’s stock, hoping to benefit from satellite tech.

The resale filing and Apple’s satellite messaging have made investors more interested in AST SpaceMobile NAS:ASTS. This has led to a big increase in the stock price.

“The launch of iOS 18 with satellite messaging has opened up new opportunities for companies like AST SpaceMobile to capitalize on the growing demand for connectivity, even in remote areas,” said an industry analyst.

The space industry is changing fast. Investors are watching AST SpaceMobile closely. They’re interested in how it will use satellite tech for growth and innovation.

Broadband Network Partnerships with Verizon and AT&T

AST SpaceMobile (NASDAQ:ASTS) has teamed up with Verizon (NYSE:VZ) and AT&T (NYSE:T), two big names in US telecom. They want to use AST SpaceMobile’s satellite tech to bring fast internet straight to phones. This will change how we use the internet.

Verizon is investing $100 million in AST SpaceMobile. This includes $65 million for service and $35 million in debt notes. This money will help launch the biggest commercial satellite in low Earth orbit. It will cover the globe with cellular broadband.

AST SpaceMobile is also working with AT&T. They will use a part of the 850 MHz spectrum, used by both Verizon and AT&T. This spectrum means better signal strength, wider coverage, and easy connection with current networks. It ensures mobile users can rely on their phones anywhere.

AST SpaceMobile’s new tech boosts each satellite’s processing power by ten times. This makes the space-based internet faster and more reliable. With these partnerships, the company aims to connect over 2.8 billion subscribers with more than 45 mobile networks worldwide.

“The collaboration with AT&T and Verizon shows how powerful AST SpaceMobile’s tech is. Using the 850 MHz spectrum, we can give users a smooth internet experience anywhere.”

Globalstar Also Benefits from Apple’s Satellite Messaging Service

Globalstar (NASDAQ:GSAT) stock went up on Tuesday, showing how Apple’s satellite messaging could help it. In 2022, Apple chose Globalstar for its iPhone 14 and iPhone 14 Pro models. These phones can send messages even when there’s no cell or Wi-Fi.

Globalstar has a big satellite network and knows a lot about satellite communication. This makes it a strong choice for off-grid connectivity. As more people use Apple’s satellite messaging, Globalstar could make more money and increase its market share. This could make its stock price go up.

Investors will keep an eye on Globalstar’s money matters and its plans with big tech companies like Apple. How well Globalstar does with its satellite projects and new partnerships will affect its future growth. This is important in the fast-changing world of satellite communications.

-

Stock Market5 months ago

Stock Market5 months agoBlue Hat Interactive Entertainment Technology (NASDAQ: BHAT)

-

Business5 months ago

Business5 months agoMaximize Your Portfolio: Top Stock Market Newsletter Tips and Free Resources for Savvy Investors”

-

Stock Market5 months ago

Stock Market5 months agoCingulate Inc Nasdaq: CING up over 200%

-

Business5 months ago

Business5 months agoThe Surge of OpenAI and Microsoft’s $13 Billion Investment in the AI Startup

-

Stock Market5 months ago

Stock Market5 months agoAST SpaceMobile NASDAQ:ASTS Surge Trending Up This Morning

-

Stock Market5 months ago

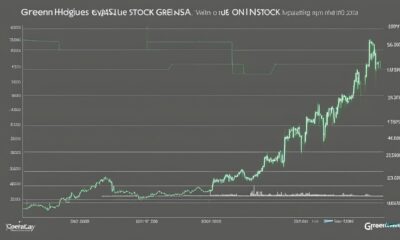

Stock Market5 months agoGreenlane Holdings NASDAQ:GNLN Surges in the Mid-day Trade Session

-

Stock Market5 months ago

Stock Market5 months agomonday.com NASDAQ:MNDY Premarket is Showing Green

-

Business5 months ago

Business5 months agoTop 5 Dividend Stocks To Own In 2024